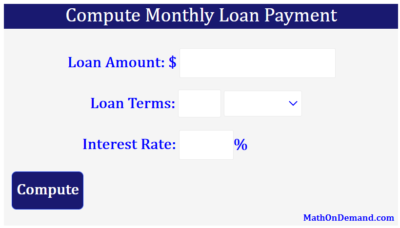

Given:

Loan Amount: $200,000

Loan Terms: 30 years = 360 months = n (convert years to months)

Interest Rate: 5% =

Monthly Loan Payment Formula:

Monthly Loan Payment =

Substitute given values into Monthly Payment Formula:

Monthly Loan Payment =

Monthly Loan Payment = $1,073.64 ( rounded to two decimal places)

Notes:

Total Cost = Monthly Loan Payment * Number of Payments

Total Cost = $1,073.64 * 360 = $386,510.40

Interest Cost = Total Cost – Loan Amount

Interest Cost = $386,510.40 – $200,000 = $186,510.40

Loan Amount: $200,000

Loan Terms: 30 years = 360 months = n (convert years to months)

Interest Rate: 5% =

5/100

= 0.05 = r (convert percent to a decimal)Monthly Loan Payment Formula:

Monthly Loan Payment =

Loan Amount *

r

/

12

/

1 – ( 1+ r/12

) -n

Substitute given values into Monthly Payment Formula:

Monthly Loan Payment =

200,000 *

0.05

/

12

/

1 – ( 1+ 0.05/12

) -360

Monthly Loan Payment = $1,073.64 ( rounded to two decimal places)

Notes:

Total Cost = Monthly Loan Payment * Number of Payments

Total Cost = $1,073.64 * 360 = $386,510.40

Interest Cost = Total Cost – Loan Amount

Interest Cost = $386,510.40 – $200,000 = $186,510.40